🛡️ Term Life vs. Whole Life: Which One Is Right for You?

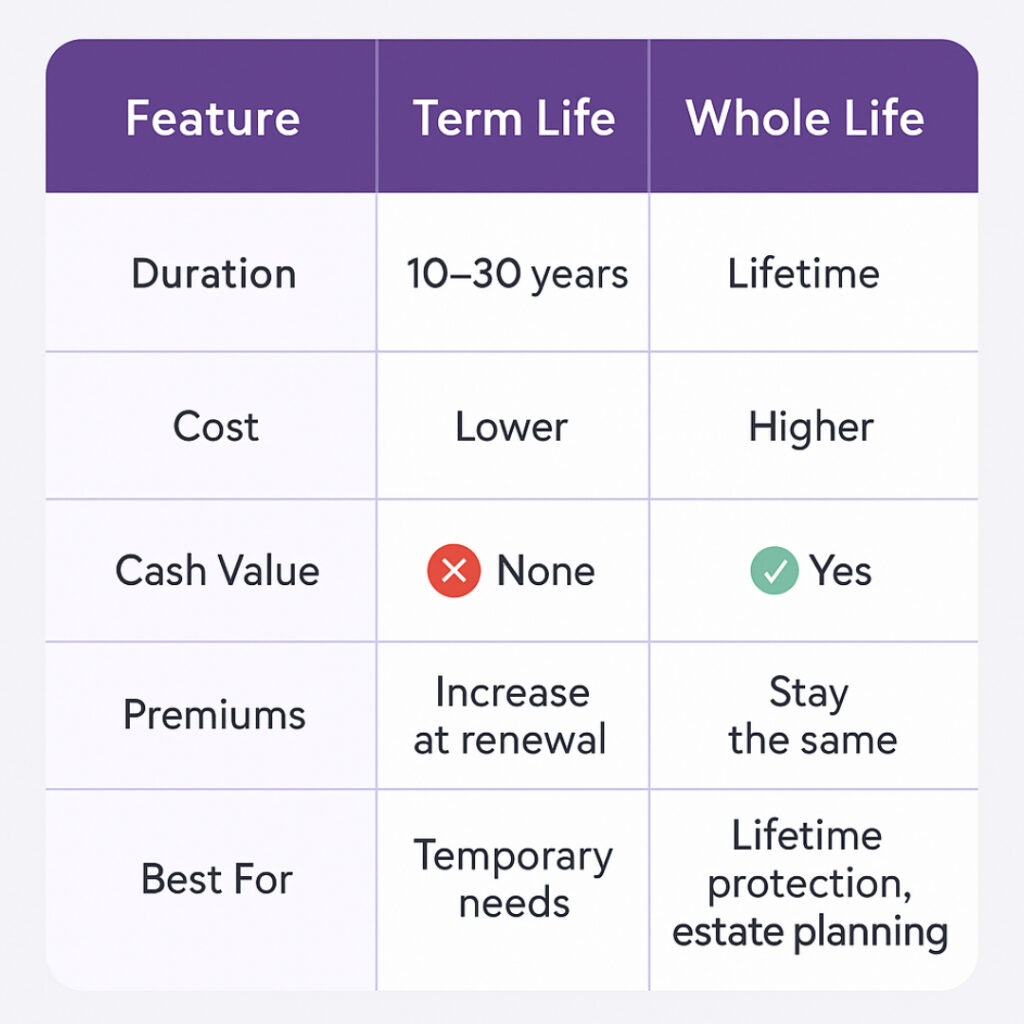

When it comes to protecting your family with life insurance, the two most common options are Term Life and Whole Life. While both offer essential protection, they serve different needs — and choosing the right one could make all the difference for your long-term financial strategy.

Let’s break it down.

⏳ What Is Term Life Insurance?

Term Life Insurance is simple, affordable coverage that lasts for a set period — like 10, 20, or 30 years.

If you pass away during the term, your beneficiary receives the full death benefit. If you outlive the policy, it ends — no payout, no cash value.

✅ Pros of Term Life:

- Very affordable — Get high coverage for low monthly cost

- Great for young families — Protects during your income-earning years

- Flexible lengths — Choose a term that matches your needs (like until your mortgage is paid off)

⚠️ Things to Consider:

- It expires — If you outlive the term, your family is no longer protected unless you renew (often at a much higher cost)

- No cash value — It’s pure protection, not an investment

♾️ What Is Whole Life Insurance?

Whole Life Insurance lasts your entire life — as long as premiums are paid. It also builds cash value, which grows over time and can be borrowed against while you’re still alive.

✅ Pros of Whole Life:

- Permanent protection — Your family is covered for life

- Builds cash value — Like a savings component inside your policy

- Level premiums — Your monthly payments never increase

⚠️ Things to Consider:

- More expensive — Whole life costs more than term, especially early on

- Takes time to build value — The cash value grows slowly at first

🎯 Which One Should You Choose?

- Choose Term Life if:

You’re looking for affordable protection during your working years — for your mortgage, young kids, or income replacement. - Choose Whole Life if:

You want lifetime coverage, to build cash value, or leave a tax-free legacy to your loved ones.

💬 Final Thoughts

Life insurance isn’t just about dying — it’s about giving your family peace of mind if the unexpected happens. Whether you choose Term, Whole, or a blend of both, the most important thing is to have coverage in place.

Still unsure which one fits your life and goals?

📞 Let’s talk. I’ll help you compare your options and find a plan that protects what matters most.

This has definitely cleared some things up for me thanks! I still have some questions and definitely would like to contact you.

This has definitely cleared some things up for me thanks! I still have some questions and definitely would like to contact you.